Business Financing Options: The Complete Guide for 2025 Entrepreneurs

Starting, growing, or scaling a business often requires one crucial element: capital. Whether you’re launching a small business, expanding operations, or bridging short-term cash flow gaps, having access to the right business financing options can determine your company’s success.

In 2025, entrepreneurs have more funding choices than ever—from traditional bank loans and SBA programs to venture capital, crowdfunding, and fintech-based lending solutions. The challenge? Understanding which financing option is best for your business.

This in-depth guide explores the most common and effective business financing options, their pros and cons, and insider tips to help you make the best financial decision for your company.

Why Business Financing Matters

Every business, regardless of size, faces the same financial hurdles:

- Startup Costs – Renting offices, purchasing equipment, hiring staff.

- Cash Flow Gaps – Covering payroll or expenses while waiting for customer payments.

- Growth Opportunities – Expanding into new markets, launching products, or acquiring competitors.

- Unexpected Expenses – Emergencies, economic shifts, or supply chain issues.

Having access to capital ensures stability, flexibility, and growth—making financing a strategic necessity.

Top Business Financing Options in 2025

Let’s break down the most effective financing choices available to small businesses, startups, and established enterprises.

1. Traditional Bank Loans

Bank loans remain one of the most common financing methods. Offered by major banks and credit unions, they provide structured repayment terms and lower interest rates than alternative lenders.

- Best For: Established businesses with strong credit history.

- Loan Size: $50,000 – $5 million+.

- Interest Rates: 5% – 12% (depending on creditworthiness).

- Pros: Lower rates, long repayment terms, credibility boost.

- Cons: Strict eligibility, collateral often required, lengthy approval process.

💡 Tip: Maintain strong business credit and financial statements to qualify.

2. SBA Loans (Small Business Administration)

The SBA partners with banks to provide government-backed loans with attractive terms. Popular SBA programs include SBA 7(a), SBA 504, and Microloans.

- Best For: Small businesses, startups, and entrepreneurs needing flexible financing.

- Loan Size: $5,000 – $5 million.

- Interest Rates: 6% – 10% (competitive).

- Pros: Low interest, longer repayment, government backing improves approval odds.

- Cons: Extensive paperwork, slower approval process.

💡 Tip: SBA 7(a) loans are best for working capital and expansion; SBA 504 loans work well for real estate and equipment financing.

3. Business Lines of Credit

A line of credit gives you access to flexible funds you can draw from when needed. You only pay interest on the amount you use.

- Best For: Managing short-term cash flow or covering seasonal expenses.

- Loan Size: $10,000 – $500,000+.

- Interest Rates: 7% – 25%.

- Pros: Flexible, revolving credit, pay interest only on used funds.

- Cons: Higher rates for weaker credit profiles.

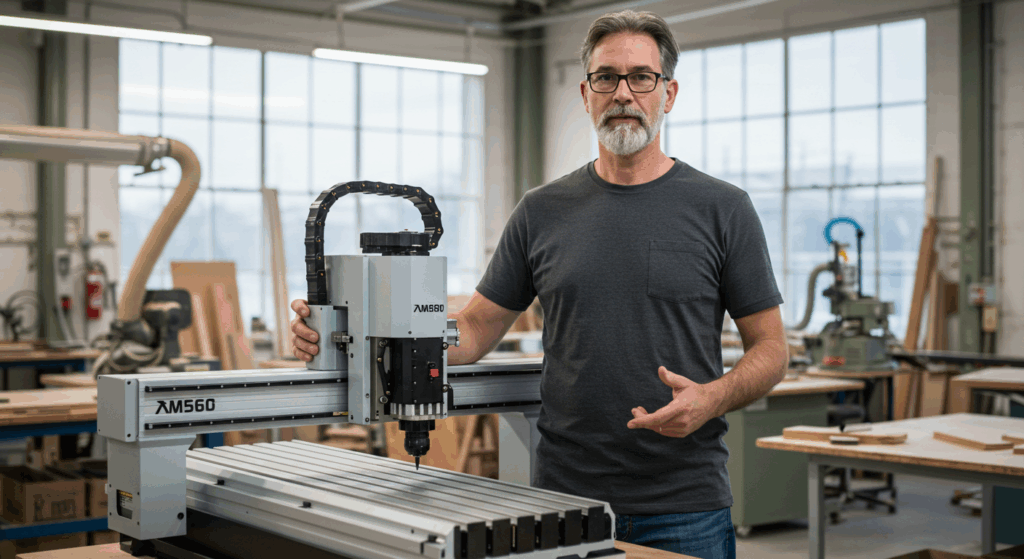

4. Equipment Financing

Businesses needing machinery, vehicles, or technology can opt for equipment financing, where the equipment itself serves as collateral.

- Best For: Manufacturing, construction, restaurants, or tech startups.

- Loan Size: $25,000 – $1 million+.

- Interest Rates: 6% – 15%.

- Pros: No additional collateral needed, ownership after repayment.

- Cons: Limited to equipment purchases.

5. Invoice Financing (Accounts Receivable Financing)

If your business struggles with delayed customer payments, invoice financing allows you to borrow against outstanding invoices.

- Best For: Businesses with long customer payment cycles.

- Loan Size: Based on invoice values ($10,000 – $5 million).

- Fees: 1% – 5% per month of invoice value.

- Pros: Quick access to cash, no need for traditional collateral.

- Cons: Higher costs, risk of dependency.

6. Merchant Cash Advances (MCA)

An MCA provides upfront cash in exchange for a percentage of future sales.

- Best For: Retail or e-commerce businesses with consistent sales.

- Loan Size: $5,000 – $500,000.

- Factor Rates: 1.1 – 1.5 (repayment tied to sales).

- Pros: Fast approval, easy qualification.

- Cons: Very high effective interest rates (30% – 100% APR).

⚠️ Warning: Use MCAs only as a last resort—they’re the most expensive financing option.

7. Venture Capital (VC)

Startups with high growth potential often seek venture capital—funding from investors in exchange for equity.

- Best For: Tech startups, innovative businesses, high-growth companies.

- Funding Size: $1 million – $100 million+.

- Pros: Large funding amounts, strategic partnerships, mentorship.

- Cons: Loss of ownership/equity, investor pressure.

8. Angel Investors

Angel investors are wealthy individuals investing in startups in exchange for equity or convertible debt.

- Best For: Early-stage startups.

- Funding Size: $25,000 – $2 million.

- Pros: Flexible terms, valuable connections.

- Cons: Partial loss of control, smaller funding pool than VC.

9. Crowdfunding

Platforms like Kickstarter, Indiegogo, and SeedInvest allow businesses to raise funds directly from consumers or investors.

- Best For: Product launches, creative projects, and startups.

- Funding Size: $10,000 – $5 million+.

- Pros: Market validation, brand exposure, no loan repayment.

- Cons: Time-consuming campaigns, platform fees.

10. Alternative & Online Lenders

Fintech platforms like Kabbage, OnDeck, and BlueVine provide fast, online business loans with flexible terms.

- Best For: Businesses rejected by banks.

- Loan Size: $5,000 – $500,000+.

- Interest Rates: 10% – 45%.

- Pros: Fast approval, less paperwork.

- Cons: Higher rates than banks.

How to Choose the Right Business Financing Option

Consider these factors before deciding:

- Business Stage – Startups benefit from VC, angels, crowdfunding; established businesses may prefer bank loans or SBA financing.

- Funding Amount – Large expansions require bigger financing (VC, bank loans), while small needs can be solved with credit lines.

- Risk Appetite – Equity financing reduces personal risk but dilutes ownership.

- Creditworthiness – Strong credit opens lower-rate financing options.

- Urgency – Online lenders and MCAs are fastest; banks and SBA loans take longer.

Tips for Securing Business Financing

- Build Strong Credit – Maintain high personal and business credit scores.

- Prepare a Solid Business Plan – Investors and banks want detailed forecasts.

- Diversify Financing – Use a mix (loan + credit line + equity) to balance risk.

- Seek Expert Advice – Accountants, advisors, and financing consultants add value.

- Compare Lenders – Shop around for the best terms before committing.

Final Thoughts

Finding the right business financing option can mean the difference between struggling and scaling. From traditional bank loans to modern crowdfunding and venture capital, today’s entrepreneurs have an unprecedented number of choices.

The key is to match the right financing method with your business’s stage, needs, and long-term goals. Whether you need $20,000 for equipment or $20 million for expansion, the financing world of 2025 has a solution for you.