VA Loan Multi-Family Guide 2025: How Veterans Can Build Wealth with Real Estate

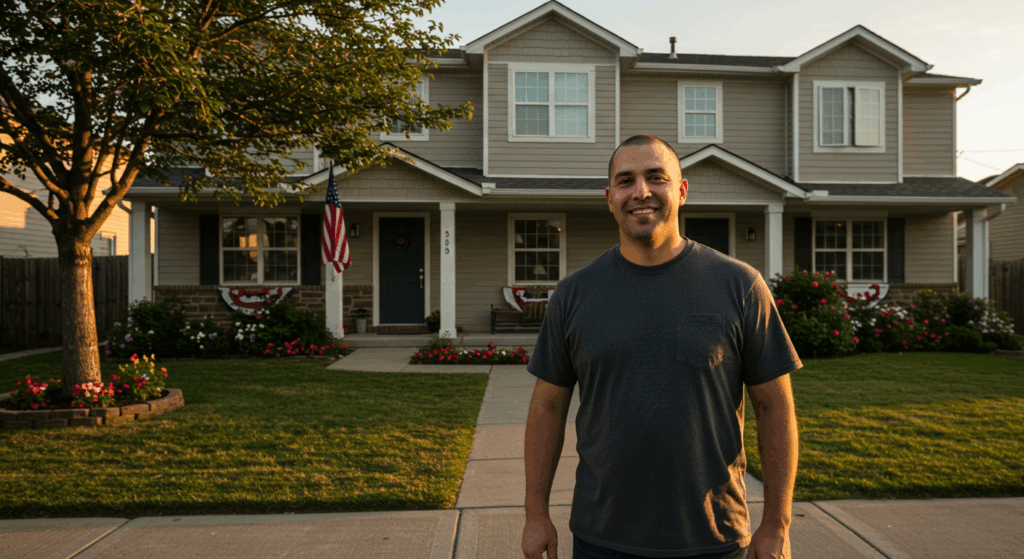

For U.S. military veterans and active-duty service members, one of the greatest financial benefits is access to the VA loan program. While most people associate VA loans with buying a single-family home, few realize this benefit can also be used to purchase multi-family properties—up to four units.

In 2025, more veterans are exploring VA loan multi-family opportunities as a way to live in one unit, rent out the others, and build long-term wealth through real estate. This guide explains how VA loans for multi-family housing work, the eligibility rules, benefits, drawbacks, and tips for maximizing this powerful financing tool.

What Is a VA Loan?

A VA loan is a mortgage guaranteed by the U.S. Department of Veterans Affairs, designed to help veterans, active-duty service members, and eligible spouses purchase or refinance homes.

Key VA loan features:

- No down payment required.

- No private mortgage insurance (PMI).

- Competitive interest rates.

- Flexible credit requirements.

Now, let’s see how these benefits apply to multi-family real estate investing.

Can You Buy Multi-Family Properties with a VA Loan?

Yes ✅ Veterans can use VA loans to purchase multi-family properties up to 4 units (duplexes, triplexes, and fourplexes).

Rules to know:

- Owner-Occupancy Requirement – You must live in one of the units as your primary residence.

- Property Type Limit – VA loans allow up to four units. Anything beyond that is considered commercial property and ineligible.

- Rental Income Can Count Toward Qualification – The VA allows you to use potential rental income from other units to help you qualify for the loan.

- VA Loan Limits – In 2025, VA loan entitlement means no set loan cap for most veterans, but lenders may set their own risk-based limits.

Benefits of Using a VA Loan for Multi-Family Properties

1. Build Wealth Through Rental Income

Renting out additional units helps cover your mortgage payment, giving you the ability to live almost rent-free.

2. No Down Payment Needed

Most investment property loans require 20–25% down, but with a VA loan, eligible veterans can secure a multi-family property with $0 down.

3. Low Interest Rates

VA loans typically offer interest rates 0.25% – 0.50% lower than conventional loans.

4. Use Future Rental Income to Qualify

Lenders may count up to 75% of anticipated rental income toward your qualifying income.

5. No PMI

Unlike FHA or conventional loans, VA loans eliminate private mortgage insurance, saving thousands annually.

VA Loan Multi-Family Eligibility Requirements

To qualify for a VA loan on a multi-family property, you must:

- Meet VA service requirements (90 days active duty, 6 years in reserves, or other eligibility).

- Obtain a Certificate of Eligibility (COE) from the VA.

- Plan to occupy one unit as your primary residence.

- Demonstrate sufficient income and credit (most lenders require 620+ credit score).

- Meet VA residual income guidelines (ensuring enough income after expenses).

VA Loan Limits for Multi-Family Properties

In 2025, VA loans have no official limit for borrowers with full entitlement. However, lenders often set practical limits based on:

- Borrower’s income and credit.

- Local property values.

- Debt-to-income (DTI) ratio requirements.

Example loan amounts:

- Duplex: $350,000 – $900,000 (depending on location).

- Triplex: $600,000 – $1.2 million.

- Fourplex: $800,000 – $1.6 million.

Multi-Family VA Loan Underwriting: How Rental Income Works

One of the biggest advantages is being able to use projected rental income from the additional units to help qualify.

- Lenders usually count 75% of fair market rent from other units.

- Rental income is verified through VA appraisals and market rent analysis.

- If you have landlord experience, it strengthens your qualification.

💡 Example:

If you buy a fourplex and each unit rents for $1,500/month, your rental income is $4,500/month counted toward loan qualification.

Challenges & Drawbacks of VA Multi-Family Loans

While powerful, there are limitations:

- Owner-Occupancy Rule – You must live in one of the units. Purely investment property is not allowed.

- Property Condition Standards – VA requires properties to meet Minimum Property Requirements (MPRs) (safe, sanitary, structurally sound).

- Higher Loan Amounts = Stricter Approval – While VA has no cap, lenders often scrutinize larger multi-family loans.

- Managing Tenants – Becoming a landlord comes with responsibility.

Step-by-Step: How to Buy a Multi-Family Property with a VA Loan

- Get Pre-Approved with a VA-approved lender.

- Obtain COE (Certificate of Eligibility).

- Find a VA-eligible property (up to 4 units, in good condition).

- Use a VA-savvy real estate agent familiar with multi-family rules.

- Submit rental income projections for qualification.

- Close with $0 down and start collecting rental income.

Example Case Study

John, a Navy veteran, purchases a fourplex in Texas:

- Price: $900,000

- Down Payment: $0 (VA loan benefit)

- Monthly Mortgage: $5,000 (including taxes/insurance)

- Rental Income from 3 units: $4,500/month

- John’s effective housing cost: $500/month

This shows how VA multi-family loans can make living expenses nearly disappear while building equity.

Alternatives to VA Multi-Family Loans

- FHA Multi-Family Loans – 3.5% down, but requires PMI.

- Conventional Loans – 20% down, stricter requirements.

- USDA Loans – Rural housing option, but not for multi-family.

Still, the VA loan remains unmatched for veterans wanting to invest in small-scale rental properties.

Tips for Success with VA Multi-Family

- Work with VA-Approved Lenders experienced in multi-family deals.

- Hire a Property Manager if managing tenants is overwhelming.

- Run Cash Flow Analysis before purchase (don’t rely only on appreciation).

- Ensure Property Meets VA Standards to avoid appraisal delays.

- Think Long-Term – Multi-family properties are both housing and an investment strategy.

Final Thoughts

The VA loan multi-family option is one of the most powerful wealth-building tools available to veterans. By allowing qualified buyers to purchase up to four-unit properties with no down payment and no PMI, the program gives service members a unique chance to combine homeownership with real estate investing.

For veterans ready to maximize their benefits, buying a duplex, triplex, or fourplex with a VA loan in 2025 can provide stable housing, passive rental income, and long-term equity growth.